With the gradual localization of upstream core optoelectronic components, the application cost of lasers will gradually decrease, and lasers will penetrate deeper into many industries. On the one hand, for China, laser processing also fits into the ten major application areas of China's manufacturing industry. It is expected that the application areas of laser processing will be further expanded in the future, and the market scale will be further expanded. On the other hand, with the continuous popularization and development of technologies such as unmanned driving, advanced assisted driving systems, service robots, and 3D sensing, more applications in automobiles, artificial intelligence, consumer electronics, face recognition, optical communication and defense research and many other fields. As the core device or component of the above-mentioned laser applications, semiconductor lasers will also gain space for rapid development.

Higher power, better beam quality, shorter wavelengths and faster frequencies

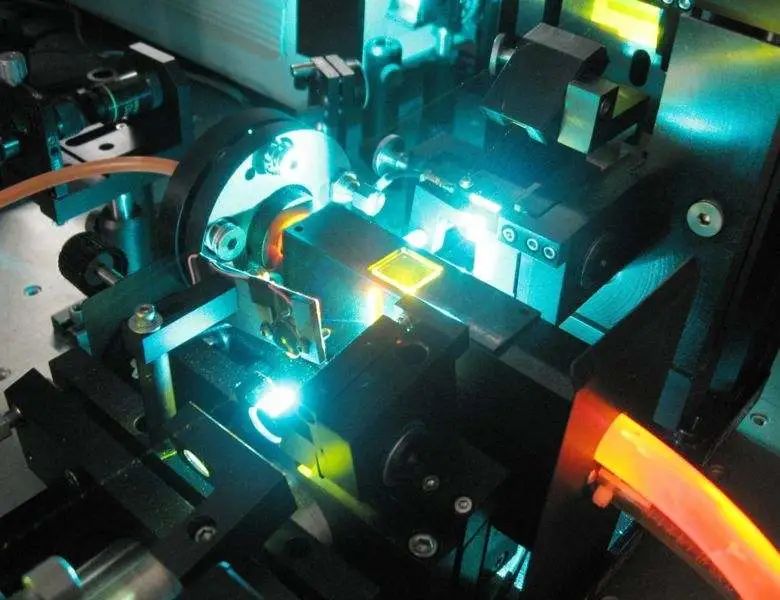

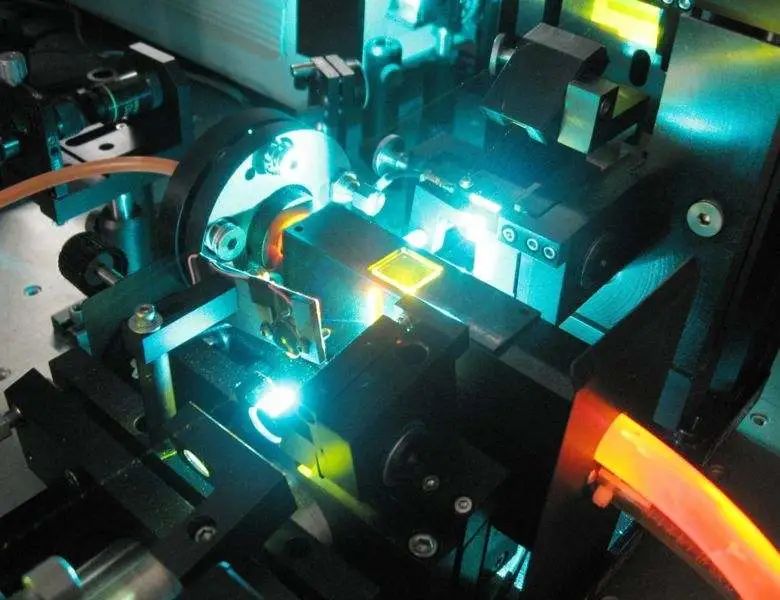

In the field of industrial lasers, fiber lasers have made tremendous progress since their inception in terms of output power, beam quality, and brightness. However, higher power can increase the processing speed, optimize the processing quality, expand the processing field to heavy industry manufacturing, and be used in cutting, welding, surface Processing, etc., the requirements for power indicators of fiber lasers continue to increase. Corresponding device manufacturers need to continuously improve the performance of core devices (such as high-power semiconductor laser chips and gain fibers), and the improvement of fiber laser power also requires advanced laser modulation technologies such as beam combining and power synthesis, which will give high-power semiconductor lasers. Chip manufacturers bring new requirements and challenges. In addition, the development of shorter wavelengths, more wavelengths, and faster (ultrafast) lasers is also an important direction, which is mainly used in integrated circuit chips, displays, consumer electronics, aerospace and other precision micromachining, as well as life sciences, medical, transmission, etc. In the fields of sense and other fields, new requirements are also put forward for semiconductor laser chips.

Demand for optoelectronic components for high-power lasers continues to grow

The R&D and industrialization of high-power fiber lasers is the result of the coordinated progress of the industry chain, which requires the support of core optoelectronic components such as pump sources, isolators, and beam combiners. The basic and key components of production, the continuous expansion of the high-power fiber laser market has also driven the market demand for upstream high-power semiconductor laser chips and other core components. At the same time, with the continuous improvement of the domestic fiber laser technology level, the realization of import substitution has become an inevitable trend, and the global laser market share will continue to increase, bringing huge opportunities for local optoelectronic component manufacturers with outstanding strength.

Nanjing Hecho Technology provides a variety of customized services for non-standard high-energy transmission optical fibers, including quartz optical fibers and glass optical fibers, which can transmit high-power lasers in the ultraviolet to infrared bands. The products are widely used in LDI Laser Direct Imaging, Plastic Laser Welding, biochemical analysis and other fields. Customized services flexibly meet the differentiated needs of different customers.